When I first started writing a blog several years ago,

fellow bloggers warned me about burnout. As someone who has the attention span

of a hummingbird, I am guilty of being susceptible to burnout. I felt

repetitive in my message, and so blogging was moved to the back burner.

Well, I’m back and giving it the old college try once again.

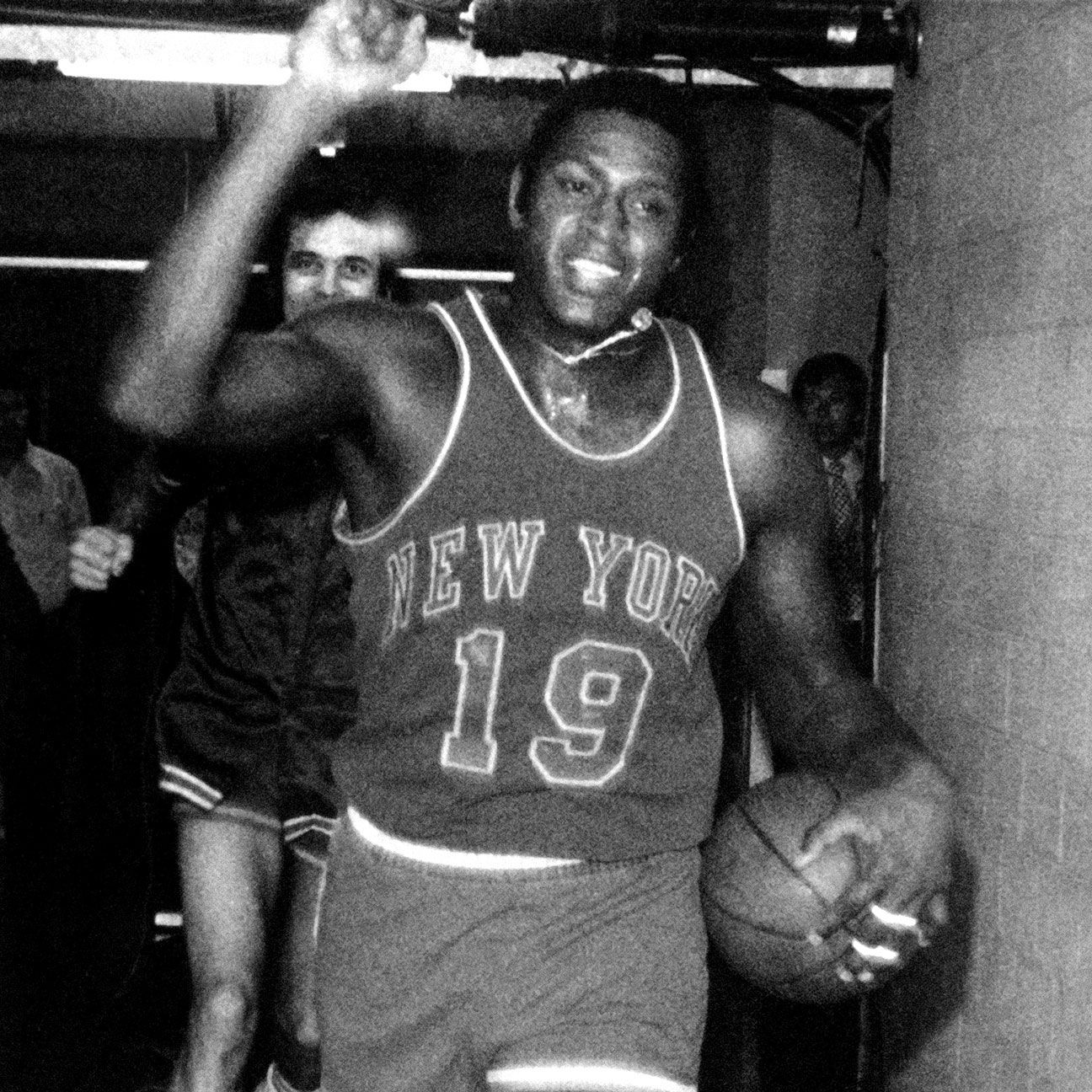

The fans have asked for more, so I am lacing up the Chuck Taylors and making my

way back to the court à la Willis Reed.

My financial message has been clear from the get-go: keep it

simple, ignore what Wall Street and the financial talking heads are saying,

keep your costs down, diversify, save as much as you can, and live your life.

That message ain’t changing!

I recently went to see the new George Clooney movie Money Monster and thought it was pretty

good. Is Clooney ever not good? The movie was a little bit dated, post

financial crisis, but still relevant. It's about an angry

investor who shows up on the set of a financial news show and takes it over.

I am still amazed when I go into a bar or restaurant and they have CNBC on in

the back ground. I can’t remember the last time I heard someone say, “Did you

hear what stock Cramer was talking about last night?” In that respect the world

of investing has changed.

When I think back to my days at Smith Barney and Bear

Stearns, it was a different era. Thousand-dollar suits, suspenders, Gucci

loafers, and slicked-back hair. The message of an advisor wasn’t important.

What was important was: can you sell, and what stock are you pitching today? At

the Smith Barney training program we didn’t discuss retirement planning, social

security, and tax strategies. It was, “Pitch me a stock, and convince me to buy

Lucent in 60 seconds.” What a disservice to all of us.

There are still many dishonest salespeople out there who

disguise themselves as advisors, but for the most part this industry has

changed for the better. It is a rare occurrence when a client calls up to buy

an individual stock. Technology has made investing better and easier. We can

build diversified portfolios using ETF’s and index funds and rebalance with one

click on the computer.

My concern after seeing Money

Monster was that the general public would be concerned that the stock

market was still rigged or fixed. It is, but for those who don’t trade often or

pay no attention to the Cramers of the world, it doesn’t matter. The market

gives you what the market gives, and as long as you still have faith in

capitalism and free markets, you can safely assume that companies will be doing

all they can to grow their earnings and move the price of their stock upward.

Hard to believe that Memorial Day is upon us. If you live

here in the Northeast, it still feels like winter. Like the stock market, the

weather can be unpredictable, but I sure hope it starts to warm up quickly!